Inherited roth ira rmd calculator

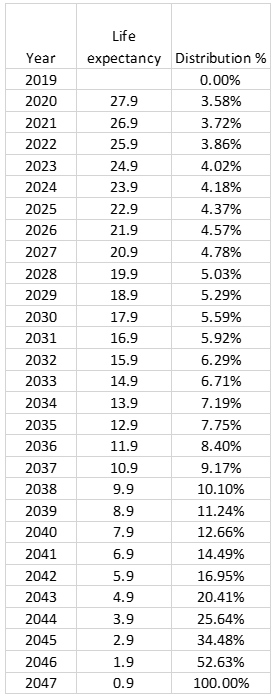

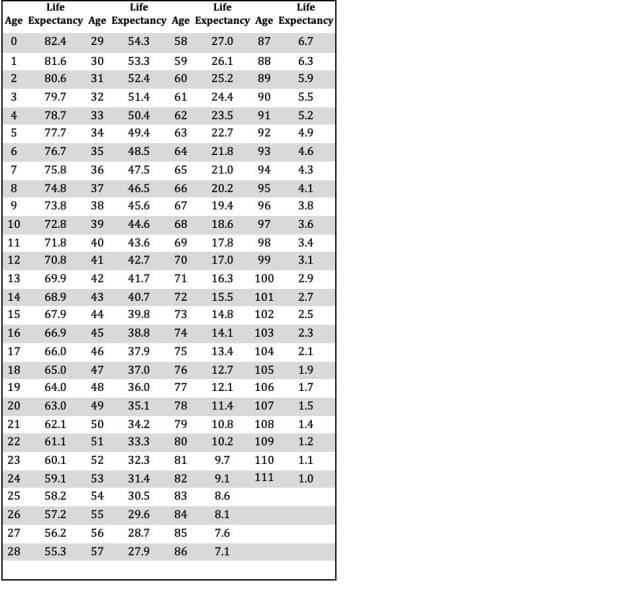

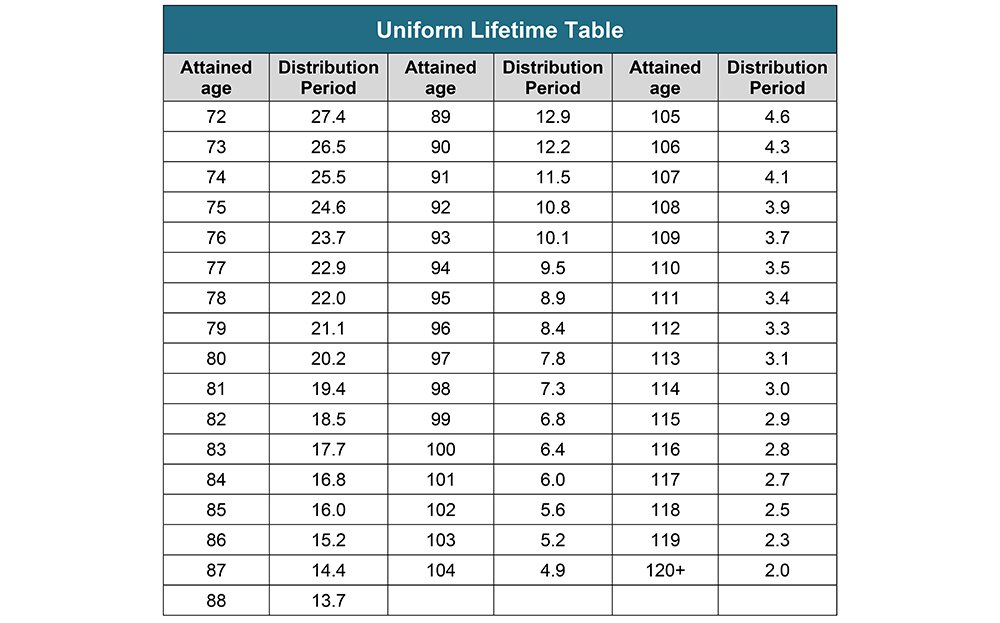

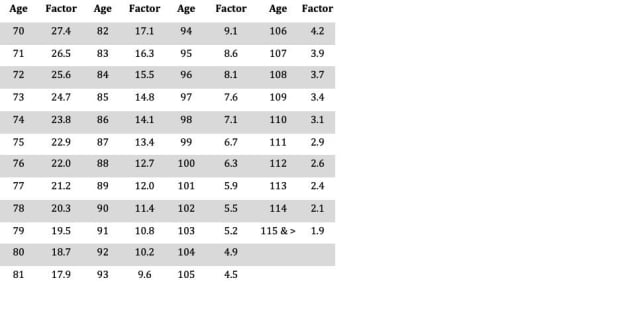

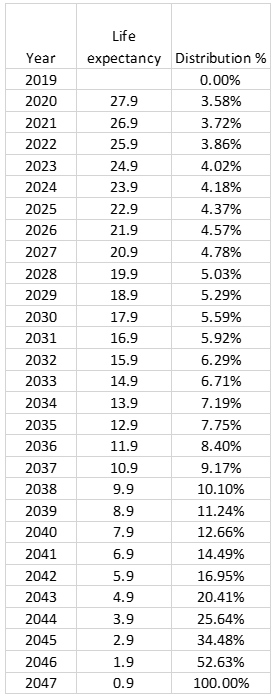

The IRS has published new Life Expectancy figures effective 112022. RMDs for Inherited IRAs are calculated based on two factors.

3

Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals.

. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. RMDs Apply to Traditional IRAs. This calculator has been updated to reflect the new.

If you want to simply take your. RMD rules do apply to beneficiaries who settle to an inherited Roth IRA. Ad Inherited an IRA.

The account balance as of December 31 of the previous year. Early withdrawals are subject to a 10 penalty. There is no required minimum distribution RMD for Roth IRAs unlike those required for.

Determine the required distributions from an inherited IRA. Calculate your earnings and more. Ad Use This Calculator to Determine Your Required Minimum Distribution.

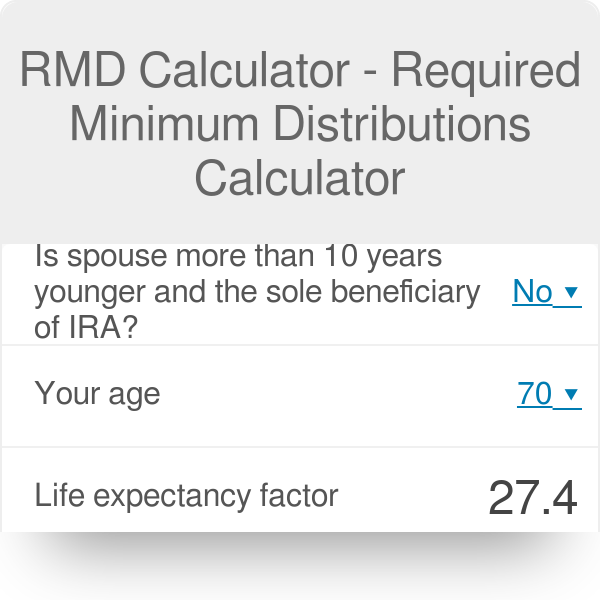

Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. These amounts are often called required minimum distributions RMDs. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track.

You must begin taking RMDs from a traditional IRA by April 1 of the year after you turn 72 the old threshold of 70½ still applies if you hit that age by Jan. Learn More About Inherited IRAs. Spouse beneficiaries can move the assets to their own Roth.

RMD amounts depend on various factors such as the decedents age at death the year of death the type of. Certain retirement plans namely 401k plans traditional IRAs SIMPLE IRAs and SEP IRAs require people to begin to withdraw money from. This calculator is undergoing maintenance for the new IRS tables.

Roth IRAs are the only tax-sheltered retirement plans that do not. There is no required minimum. This calculator determines the minimum required distribution known as both RMD or MRD which is really confusing from an inherited IRA based on the IRS single life expectancy table.

For assistance please contact 800-435-4000. The 10-year rule applies regardless of whether the participant dies before on or after the required beginning date RBDthe age at which they had to begin RMDs. When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take.

Inherited Roth IRA Rmd Calculator. IRA Tools. Allows talk about the.

Spouse may become account owner. If youve inherited an IRA depending on your beneficiary classification you may be required to take annual withdrawalsalso known as required minimum distributions RMDs. This calculator has been updated for the.

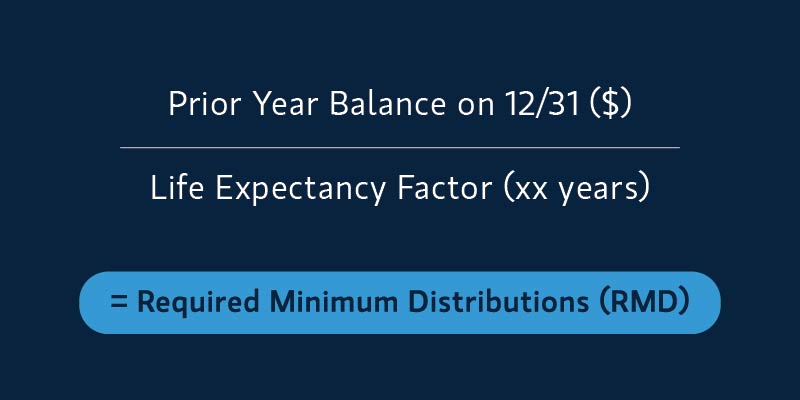

If you are age 72 you may be subject to taking annual withdrawals known as. The RMD formula is. The IRS requires that most owners of IRAs withdraw part of their tax-deferred savings each year starting at age 72 age 70½ if you attained age 70½ before 2020 or after inheriting any IRA.

RMD rules do not apply to the original Roth IRA owner. If you had a transfer or rollover to your Schwab retirement accounts a conversion from a traditional IRA to a Roth IRA and back or any correction for security price after year-end. Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly.

The IRS implemented new Life Expectancy Tables on January 1 2022 for use in calculating required minimum distributions from accounts that qualify. Normal RMD rules apply based on spouses age. How To Calculate RMD For Inherited IRAs.

Or spouse may take life expectancy. Enjoy Tax-Deferred Growth No Early Withdrawal Penalty When You Open An Inherited IRA. Thinking youre not around to retire next year you want development as well as concentrated investments for your Roth IRA.

RMDs are also waived for IRA owners who turned 70 12 in 2019 and were required to take an RMD by April 1 2020 and have not yet done so. Schwab Can Help You Through The Process.

Rmd Table Rules Requirements By Account Type

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Rmd Calculators Required Minimum Distributions Charles Schwab Required Minimum Distribution Inherited Ira Financial Planner

Required Minimum Distribution Rules Sensible Money

How Required Minimum Distributions Work Merriman

Inherited Ira Rmd Calculator Td Ameritrade

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

3

1

Required Minimum Distributions For Retirement Morgan Stanley

3

Avoid This Rmd Tax Trap Kiplinger

Your Search For The New Life Expectancy Tables Is Over Ascensus

Ira Rmd By Symons Software Solutions Llc

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Rmd Calculator Required Minimum Distributions Calculator

The Inherited Ira Portfolio Seeking Alpha